The teams from CommFirst Federal Credit Union and Brightview Federal Credit Union are joined together as of February 1, 2022. This partnership strengthens our position as your financial partner, and opens additional opportunities for new products, services, and resources. We are dedicated to working closely with our team and our membership to make the transition as smooth as possible. As a combined credit union under the Brightview Federal Credit Union name, we can better maneuver through the many changes the financial industry is experiencing due to government regulations, technology and more. We will continue to uphold the missions of CommFirst and Brightview by dedicating our commitment to the community and empowering our membership to enjoy more happiness, confidence, and financial stability.

History

The depression hit America in October 1929 and many businesses failed. Even in the financial industry, some 5,000 banks failed during the period from 1930 to 1932. However, during this same period, credit unions not only survived but thrived.

In 1950, a group of employees of the Mississippi Employment Security Commission formally petitioned the Bureau of Federal Credit Unions for a charter to establish a credit union to serve the commission’s employees and their family members.

In 1956, a group of employees from the Mississippi Baptist Health Center formally petitioned the Bureau of Federal Credit Unions for a Charter to establish a credit union to serve the employees of the Baptist Heath Centers and their family members across the state.

Both CommFirst FCU and Brightview FCU have had many successes throughout the years, and we anticipate the same as we move forward together.

Questions & Answers

What is happening?

CommFirst Federal Credit Union is excited to announce the proposed merger with Brightview Federal Credit Union. By joining forces, we can provide an enhanced member experience and added convenience for all members.

Why merge?

Both credit unions share a culture that is guided by service to our members. With our member-centric focus, we bring together two like-minded credit unions. A merger allows two healthy credit unions to combine their vision, experience, and resources for the benefit of the membership, employees, and community.

How will this partnership benefit the members?

The opportunity to combine operational resources and talent will enable these two strong regional credit unions to expand their branch and ATM networks. A strong combined asset and capital base will assist in keeping rates on financial products and services low, position the credit union for continued growth, and deepen community involvement. Brightview Federal Credit Union has a wide variety of products and services to be added to the CommFirst Federal Credit Union portfolio, including various credit card options, mortgage lending, and more. CommFirst Federal Credit Union has an established financial foundation that will enhance the combined credit union’s ability to match technological advancements in the financial industry.

Is this partnership a good fit?

We believe that this partnership is a great fit. We share a common bond and commitment to our members, our employees and our communities. Led by our strong core values, together we also firmly believe in the importance of taking care of our members. It is our mission to do so.

Will the credit union’s name change?

The CommFirst Federal Credit Union name will change. The continuing credit union’s name will be Brightview Federal Credit Union.

What is the timeline for the merger?

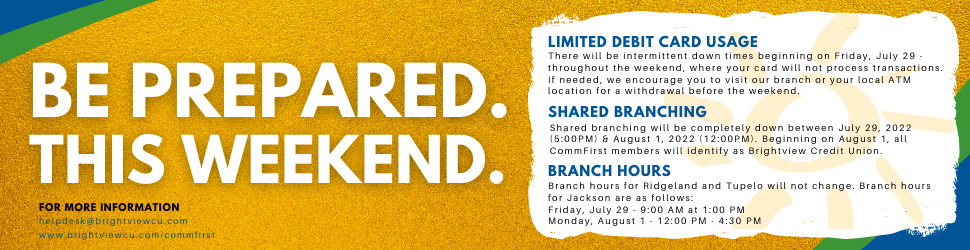

The documented merger is effective as of February 1, 2022. The next step is the consolidation of CommFirst members’ information through a data conversion to the Brightview system. That process is projected to take place the weekend of July 29, 2022 and will be complete by noon of August 1, 2022.

Will current branches change after the merger?

The CommFirst credit union office located in Jackson, MS will become a branch of Brightview Credit Union.

Will the CommFirst employees I know and appreciate still be a part of the combined credit union?

Absolutely! You will see the same familiar faces you have come to know and enjoy!

How will the integration of the two credit unions be managed?

Both credit unions have been working together to develop a well-defined process for managing the integration. Beyond the continued daily service to members, the merger is top priority. Systems, policies, accounts, teams, branches, training, member communication, etc. are all being considered. The management of both credit unions are excited and confident about combining the best practices of both credit unions.

How will this affect current Brightview members?

Brightview members will not need to re-enroll into online banking and will experience no change to membership numbers, checks, nor plastic cards except some intermittent outages the weekend of the merger.

Will my account number change?

Although membership numbers will not change, there will be a slight adjustment for CommFirst members to the suffix or account numbers for some members. We will reach out to those members ahead of time.

Will we be getting new statements and, if so, when?

After the systems conversion on the weekend of July 29, the processor for Brightview will begin issuing statements. After that, all future statements will come from Brightview.

What happens to my debit card?

You should have minimal interruptions with your debit card during between 07/29 – 08/01. You may experience intermittent outages. For CommFirst members only::::The next time your CommFirst card expires, you will receive a new card with a different card number, and the previous card will stop working after the new card is activated. We will be reaching out to each individual personally to discuss this change so there is no surprise or inconvenience.

If I have already set up a direct deposit, do I need to do anything?

No, you as the member will not have to do anything. This will be something that is handled by the credit union on your behalf.

Will the institution routing number change?

Once the merger takes place, Brightview will have “ownership” of the CommFirst routing number. In other words, the Federal Reserve will know that CommFirst items need to come to us. Eventually the combined credit union will use only the Brightview routing number as we gradually make the necessary changes behind the scenes.

How long will I be able to use my CommFirst checks?

Until you have exhausted the supply. We will work with the Federal Reserve to make sure that CommFirst checks are routed through your new Brightview account following the account migration the weekend of July 30. In short, you can use your checks and they will continue to clear your account.

If I mail my loan payment or deposit, do they need to go to a different address?

You should continue to mail payments to the same address you currently use.

What about staff e-mail addresses? Will they be changing?

Yes. On Monday, August 1, the CommFirst team will be using their new Brightview business e-mail address. We will be providing CommFirst staff with that information leading up to the merger so that they can share. Brightview Credit Union email addresses will not change.

Will the branch phone number change?

It will not. We will simply add the Brightview toll free 800 number to the mix so that you can reach us should you have a question.

Will my deposits continue to be insured by the NCUA?

They will up to $250,000 per shareowner. But if you have, or plan on having, more than that on deposit give us a call for how to possibly protect deposits beyond that base amount. You can also visit the NCUA website at www.MyCreditUnion.gov/estimator. This interactive site allows you to input data to calculate the amount of insured deposits, under different scenarios, available to you.

Will there be any change to account notices, receipts or statements?

Beginning on August 1, all CommFirst members will see the Brightview logo on all materials they receive from the credit union. You will begin to see the Brightview logo on some materials immediately.

Can I use other Brightview branches even though they aren’t in CommFirst?

Absolutely! If you see a Brightview branch… that is your credit union, stop in! They will have some access to your account information. Just remember, they will not have had the same pleasure of working with you over the years, like the team in CommFirst, and will need to get to know you by asking for identification.

DEPOSITS

If I have long-term share certificate will my current rates and maturity be honored after the merger?

Yes, all rates and terms of share certificates currently held by members of CommFirst will be honored as originally contracted. At maturity, you will have the option to redeem your funds or allow the certificate balance to roll over to the closest term certificate offered by Brightview at the current offering rate.

LENDING

Will interest rates change on my existing loan?

Your interest rates will not change. You have a contract and the rate and terms you have as a CommFirst member will be honored for the term of that loan.

What kind of consumer lending does Brightview offer to members?

You will have access to a full suite of mortgage lending products to refinance or purchase a home. We have a variety of personal loans, secured and signature, available for the purchase of autos, boats, motorcycles, ATVs, boats, credit cards, and more. All of our consumer lending products are competitively priced and, based upon underwriting including your FICO score, can even get more competitive.

Can I purchase a car or truck at a local dealership and finance it through the credit union?

Absolutely! We have worked with many dealerships to provide financing all over the state.

Does Brightview have student loans?

We partner with Sallie Mae for these requests.

ONLINE ACCESS

Will I lose access to my account online?

You will no longer access your accounts through www.commfirstfcu.com. You will be able to access your account through www.brightviewcu.com. The first time you access your account, you will need to enroll into the online banking portal by clicking “Enroll” on the login screen. Your pin number for enrollment will be the last 4 digits of your social security number. Any billpay portal payments will need to be setup again. Any external recurring transfers will need to be setup again.

There will be a temporary interruption in the mobile application. Once available, you can download the new app under Brightview Credit Union on your Apple or Google App Store.

If you would like to ask a specific question not listed above, please submit it below.